05/07/2022

Sabancı University Istanbul International Center for Energy and Climate (IICEC) continues to enlighten the public with events it organizes on energy and climate, which are among the most important issues facing the world. This time, IICEC covered the issue of energy security, which is at the top of the global agenda and has become much more important with the Russia-Ukraine war, together with clean energy trends, at the "Energy Security, Clean Energy & The Role of Finance" conference and panel held in Istanbul.

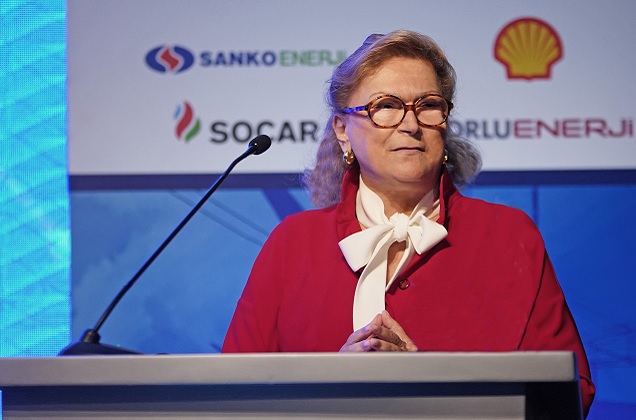

Held at Sabancı Center and opening with the opening speech of Founding Chair of Sabancı University Board of Trustees Güler Sabancı, the conference included speeches delivered by EBRD Turkey Director Arvid Tuerkner and IEA Executive Director and IICEC Honorary Chair, Dr. Fatih Birol.

“We are faced with a multidimensional energy security paradigm.”

Starting her speech by thanking the participants and congratulating Dr. Fatih Birol, who was unanimously elected as the IEA Director for the third term in March, Güler Sabancı said, “Under the management of Dr. Fatih Birol, the International Energy Agency has become an organization that shapes 'global energy security' and leads the 'global clean energy transformation'. From here, he will go to the G7 Leaders' Summit to make speeches and hold bilateral talks on energy and climate upon the invitation of the G7 Term President, German Chancellor Olaf Scholz. Today, we will have the privilege of listening to Dr. Fatih Birol about the latest developments and future perspectives in the field of energy and climate.

“Recently, with the global and regional developments, energy security has come to the top of the world agenda. We are faced with a multidimensional energy security paradigm that encompasses the supply chains of oil, natural gas, other fuels, electric power, and clean energy technologies. On the other hand, we are in a period in which important steps should continue without any interruption in order to ensure a more sustainable future for our planet in terms of climate security and clean energy, as well as supporting social and economic development goals. A more sustainable future requires a holistic perspective that strengthens energy security and supports growth in clean energy. We need to grow with sustainable investments and financing with a focus on efficiency, competitiveness, innovative business models, and clean energy technologies.”

“IICEC is a leading model and center in Turkey”

“At Sabancı University, we have given priority to energy and climate issues for a long time. We founded IICEC as an energy and climate center with the vision that these two issues are inseparable. Within the model that I define as the 'Success Triangle', IICEC continues to bring together the public, private sector, and academia to create collective wisdom towards goals that will support a safer and cleaner energy future. I am very pleased to see that IICEC is expanding its cooperation and sphere of influence within the ecosystem.

“IICEC published the 'Turkey Energy Outlook' report, breaking new ground in Turkey in 2020. This study, which was adopted by the stakeholders of the sector, has become a source of reference. Last year, IICEC published the 'Turkey Electric Vehicles Outlook' study, again for the first time in Turkey. This year, within the perspective of its "Outlook" series, IICEC continues its studies on "Renewable Energy", which is one of the most important opportunity areas in Turkey. It develops the 'Turkey Renewable Energy Outlook' study, again with a holistic and analytical perspective and with a participatory approach with the stakeholders of the sector. Creating value from science-based approaches and business collaborations has become one of the most critical success factors today. In this perspective, IICEC is a leading model and center in Turkey.”

“Turkey has the potential to become a green hydrogen exporter in the long run”

Noting that the energy security and decarbonization agendas have become mutually supportive, EBRD Turkey Director Arvid Tuerkner said the following: “Today the topic of renewable energy has become even more convincing. Increasing renewable energy capacity will free up natural gas for export and create an opportunity to transform renewable energy into green hydrogen to develop more complex products. This will ultimately help decarbonize energy-intensive industries.

“Turkey has the potential to become a green hydrogen exporter in the long term, in addition to domestic use, to help achieve net-zero emissions in sectors that are difficult to decarbonize and to reach the net-zero target of 2053. The last decade has seen impressive growth in renewable energy production. Thanks to Turkey's solar and wind power generation potential, we hope that we will see a further increase in this growth going forward.

“Through the Ministry of Commerce's 'National Green Deal Action Plan', Turkey has announced plans to develop decarbonization roadmaps for a number of carbon-intensive sectors. We are currently working in partnership with the Ministry of Industry and Technology on a 2053 decarbonization roadmap for Turkish industrial sectors, which will also be the first to be impacted by the Carbon Border Adjustment Mechanism. These sectors are aluminum, cement, fertilizer, and steel.

“Additionally, the EBRD Green Cities, the Bank's flagship program and the largest financing framework ever, has been expanded to reach a total of €5 billion. Four cities, Ankara, Gaziantep, Istanbul, and Izmir, joined the program following green investment projects ranging from clean urban transportation to renewable energy generation for municipal uses. We also help small and medium-sized businesses and homeowners invest in green technologies through our Green Economy Financing Programs, our GEFFs (Green Economy Financing Loan). Through the EBRD's programs in Turkey, TurSEFF (Turkey Sustainable Energy Financing Programme), MidSEFF (Turkey Medium-Scale Sustainable Energy Financing Programme), and TuREEFF (Turkish Housing Energy Efficiency Financing Programme), 2 billion Euros were invested in projects in Turkey. The EBRD also announced a new 500 million Euro framework this year under the name of GEFF Turkey and the first loan transactions started to take place.”

“This crisis could be a turning point for the energy world”

Stating that it is thanks to the vision of Güler Sabancı that IICEC is 12 years old and carries out studies as a guide to such important issues, Dr. Fatih Birol continued: “With the invasion of Ukraine by Russia on February 24, the world began to experience its first global energy crisis. We are currently in the middle of the first global energy crisis. It does not seem possible for the world to get out of this energy crisis in a short time. This energy crisis brings along other crises, especially food crises. Besides, we are experiencing a humanitarian crisis in Ukraine.

“We had oil crises in the 70s, but then there was only the oil crisis. Now we are faced with serious problems with oil, natural gas, coal, and electricity. If we look at that oil crisis, there was a very serious increase in inflation. Now we can see this again. The second thing is recession. I think we're slowly getting there now. But the oil crisis of the 70s didn't just cause recessions and inflation; new issues such as energy saving, energy security came to the forefront. It was a reaction and it suddenly changed the entire automotive industry. The second reaction developed by countries against oil shocks was the nuclear industry. 40 percent of the nuclear power plants currently used by the world are the power plants established in response to the energy crisis at that time. I say this because we have had very difficult days due to the crisis and I think we will have much more difficult days. I see that there will be a reaction like the reaction to the crises in the 70s. We are leading this. That's why I think this crisis could be a turning point in the energy world.”

“We prepared a 10-point action plan for Europe and shared it with the leaders”

“If we look at the markets, oil prices are over $100 and contribute a lot to inflation. One of my concerns is that the situation could become more serious as summer approaches. That's because demand for oil typically starts to rise as we approach the summer months. If the producing countries in the Middle East put the oil they currently have in their stocks on the market and increase production, this will create relief in prices. However, if there is no serious weakening in the economy and oil-producing countries do not take new steps, Europe may face a very serious problem.

“Currently, the stocks available to the countries in Europe are really at an extremely low level. That's why we prepared a 10-point action plan for Europe and shared it with European leaders. Many countries, including Germany, implement certain parts of this plan. What are these actions? Reducing the natural gas heating thermometer in the house by one or two degrees. According to our calculations, if we heat homes in Europe by two degrees less, the amount of gas we will save will be equal to gas coming to Europe via Russia's largest pipeline. In our letter to European governments a month ago, we explained the countries' gas distribution restriction plan to be carried out in an emergency. Programs to restrict gas shipments need to be drawn up on a regular basis. Meanwhile, while Europe is taking these steps to reduce natural gas imported from Russia, Russia may cut off all natural gas. Such a possibility, I think, is on the table.”

“Decisions to be taken in the energy crisis should not put a crimp on the fight against the climate crisis”

“The current situation of these markets is not very encouraging. Now there is another crisis, the climate crisis. 80% of the emissions that cause the climate crisis in the world come from the energy sector. In some countries, we see that fossil energy investments may come as a serious wave in some sectors as a reflex to the current situation. Therefore, the decisions we will take in the energy crisis should not put a crimp on our fight against the climate crisis. While we want to bring energy security under control, we should not make the climate crisis worse.”

“We see a growth of 12 percent in clean energy investments in 2022”

“For the first time in 2022, we see a significant growth of up to 12 percent in clean energy investments. In addition, there is good news about electric cars. In 2019, 2 out of every 100 cars sold in the world were electric cars. Our expectation this year is that 15 out of every hundred cars will be electric cars. In other words, an increase from 2 percent to 15 percent.”

“The world is already returning to nuclear energy”

Answering a question about the increase in demand for nuclear energy, Dr. Fatih Birol emphasized that there has been a comeback for nuclear energy in the recent period and said, “I observe that the interest in nuclear energy has increased very seriously everywhere after the invasion of Ukraine. We have suggested to the governments of Belgium, Germany, and Japan that they consider putting nuclear back on the agenda. Because circumstances demand it. First, energy security. Second, the increase in natural gas prices. It would be an extremely optimistic expectation to expect natural gas prices to decrease in a short period of time. Third, the share of renewable energy in the world will gradually increase. When renewable energy increases, you need an option such as nuclear to provide a certain security in systems and networks. The world is already returning to nuclear energy. Many European countries, especially the UK, USA and France, are countries that give the lion's share to nuclear in their new energy strategies. However, the development of a new technology called the small modular reactor, which speeds up the construction process in nuclear, continues. These are technologies that are much more flexible, built very quickly, and can be put into operation immediately. These are not yet commercialized, but many are working on it. I think in the next five or six years these will become commercial, by 2030.”

The latest developments in climate and energy were evaluated at the panel

The speeches were followed by a panel moderated by Dr. Mustafa Oğuz Afacan, Sabancı University Faculty Member. At the panel, TSKB General Manager Murat Bilgiç, Borusan Holding Group CEO Erkan Kafadar, ING Turkey Board Member Semra Kuran and SHELL Europe & Sub-Saharan Africa Vice President for Corporate Relations Rob Sherwin gave speeches on “Energy Security, Clean Energy & The Role of Finance”.

“We contribute to the reduction of approximately 16 million tons of CO2 emissions annually”

TSKB General Manager Murat Bilgiç: “Since 2002, we have continued to support projects realized in the field of renewable energy in Turkey. Energy projects such as hydroelectric power plants, solar, wind, biomass, and geothermal power plants, which we financed, represent 15 percent of Turkey's total installed renewable energy power. At TSKB, we contribute to the reduction of approximately 16 million tons of CO2 emissions annually with the financing we provide for renewable energy and energy efficiency projects.

“In order for Turkey to realize its significant renewable energy potential, we believe that the development of the sector should be supported with green bonds, public offerings, and new financing methods, as well as investment loans. Therefore, at TSKB, we will continue to support renewable energy investments, which will be realized through new facility investments and capacity increases, with all our business lines, as part of Turkey's energy policy. We strive to enrich our funding sources, financing models, and consultancy services with new ESG-focused initiatives. We have an SDG-related financing target of 8 billion USD by 2030. We aim to maintain the ratio of these loans at 90 percent between 2021-2025.”

“Global climate change and energy crisis have accelerated the transition to green energy”

Borusan Holding CEO Erkan Kafadar: “The climate change and the energy crisis we are experiencing have accelerated the transformation to green energy and green economy all over the world. Ensuring energy supply security and investing in renewable energy-oriented supply are the main axes of this transformation. Energy policies planned in coordination with economic development and a more predictable free market are of great importance for this transformation.

“Within the scope of the strategy to be clarified in this framework, the establishment of the infrastructures for the required connection capacity together with the increased system flexibility will ensure the integration of more renewable energy capacity into the grid. Developing regulations for facilitating license processes and access to favorable financing conditions will constitute important steps in improving the investment climate. I believe that the publication of the Climate Law within the 2053 Net Zero Emissions Target, the completion of the Green Deal Action Plan, and the establishment of the Emissions Trading System (ETS) will accelerate this transformation process. The development of our human resources that will carry out all these processes and the supplier ecosystem is an indispensable part of this transformation.”

“The finance sector has started to take the necessary steps for renewable energy”

ING Turkey Board Member Semra Kuran: “The energy sector is one of the most important tools for combating climate change and having a sustainable economy. As governments, companies, and institutions, it is critical that we all move towards a common goal. Everyone needs to invest in this journey. In this context, it will be very important for the financial services sector to encourage and support its customers' investments in the transition to the 'green' area by providing access to additional capital and financing under favorable conditions. For this reason, it is of great importance that the finance sector examines and reports all sectors on the basis of clean energy. At this point, not only financial support but also consultancy to companies in need is very important in terms of providing sustainability financing from international institutions.

“We see that institutions in the finance sector have started to take the necessary steps for renewable energy. As one of the early starters, we, at the ING Group, announced that we aim to increase our financing of renewable energy by 50% by the end of 2025. At ING Turkey, we will continue to transfer our international experience to our country, expand our product range and work towards a sustainable world.”

“The war in Ukraine showed the importance of diversifying energy supply”

SHELL Europe & Sub-Saharan Africa Vice President for Corporate Relations Rob Sherwin: “While the war in Ukraine is a human tragedy, it showed us all the importance of diversifying energy supplies. The world continues to need more and cleaner energy. For this reason, at Shell, we continue our 'Powering Progress' strategy, which we have put forward with the aim of helping our customers decarbonize.

“Beyond that, incentives such as the support of many governments for renewable energy to reduce dependency on imported fossil fuels will accelerate the steps we take in this direction. However, as we move towards a world with net-zero carbon emissions, the vital role of oil and gas continues in all scenarios, especially for the continuity of the sectors that are most difficult to decarbonize.”